Nifty Psubank, Nifty Metal, and Nifty Auto drag nifty down the market. Today Nifty is down -1.25% i.e. closed at 24,472.10 and Sensex is down -1.15% closing at 80,220.72.

The news could impact tomorrow 23 Oct 2024

- Ambuja Cement on Tuesday announced that it will acquire 46.8% of Orient Cement Ltd (OCL).

- The finance sector holds a significant share in both Nifty and Sensex. The RBI has already warned NBFCs about the issue of unsecured loans. Due to the nature of these unsecured loans, NBFCs and private banks must make provisions, which could impact their financial results. This may lead to an increase in NPAs. For example, Axis Bank’s Q2 provisions jumped to ₹2,204 crore, driven by elevated retail slippages. Morgan Standly said RBI may take action on such NBFC for unfair lending practices.

According to the IMF’s World Economic Outlook projections, India’s future growth remains robust, positioning it as a key driver of global economic growth, particularly in Emerging and Developing Asia. The projections show:

2023: India’s economy is expected to grow by 8.2%, which is the highest among major economies globally.

2024: The growth rate is projected to slow slightly to 7.3%, still maintaining strong momentum compared to other countries.

2025: India’s economy is expected to continue its growth trajectory with a forecasted growth rate of 6.5%.- NBCC secures orders worth ₹168 crore and subsidiary bags orders worth ₹1322.48 crore.

- Mazagon Dock announces 1:2 stock split, an interim dividend of Rs 23.19 per share.

- Reliance Infra aims to build India’s largest pvt sector greenfield defence project in Maharashtra with Rs 10,000 cr investment

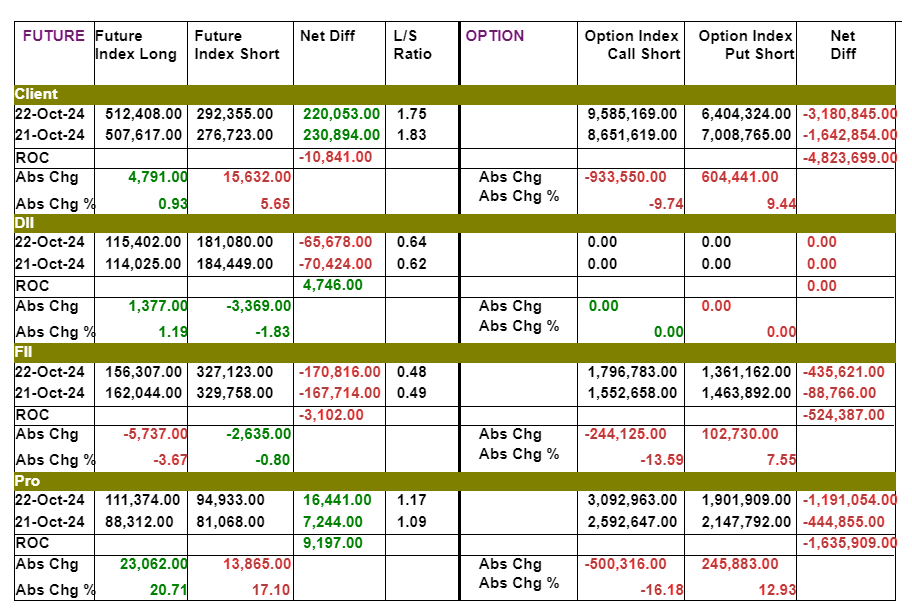

FII : Cut the Future Index Long as well as Short position but In index option increased index call short position compare to option put short.

DII : Increase Future index long position compare to Future index short position.

Pro : Increase fugture index long position compare to index short future position and in option index call short postition are moree than put short option postion

List of companies’ result tomorrow 23-Oct-2024

BAJAJFINSV, BAJAJHLDNG, BIRLACORPN , BSOFT , CARE RATING , GODREJPROP, HERITGFOOD, HINDUNILVR, IIFL,KPITTECH, LALPATHLAB, NDTV, PEL, PIDILITIND, SBILIFE, SYNGENE

Gold Rate today : 10g of 24k gold (99.9%) in Mumbai is 80,395.00 Indian Rupee